Generational Perspectives in Financial Services

The use of generational segmentation has taken hold in the financial services industry. Seemingly everyone is enamored with the pursuit of Gen Z and Millennials as attractive targets. Certainly, there are differences between the various generations as they all came of age during different periods. But are those differences more important than the common elements they all share?

Demographic Trends

There were about 126 million households in the US in 2020, according to ESRI estimates. Historically, financial decisions have been made at household levels, which makes sense when you think about family format. Major financial decisions are often made as a household unit.

There are numerous approaches to carving those households into logical segments in order to better understand their needs. Dozens of commercial segmentation systems exist. I know because early in my career I developed a few of them. Generational segmentation strategies are now in favor but typically used at the individual level rather than the household level. For retail financial services, I’ve always been attracted to using a framework based on the “Age of Household Head by Household Income” approach, as it speaks to the changes in financial services needs as people move through different life stages. With that framework in mind, I wondered whether I could make the two approaches work together.

The classic format for an Age of Head of Household by Median Household Income data is a 7x9 matrix. Original data is derived from the Census then updated and projected forward by ESRI, along with 100s of other demographic factors. Those matrix categories are:

The current general segmentation structure in use today contains five primary segments:

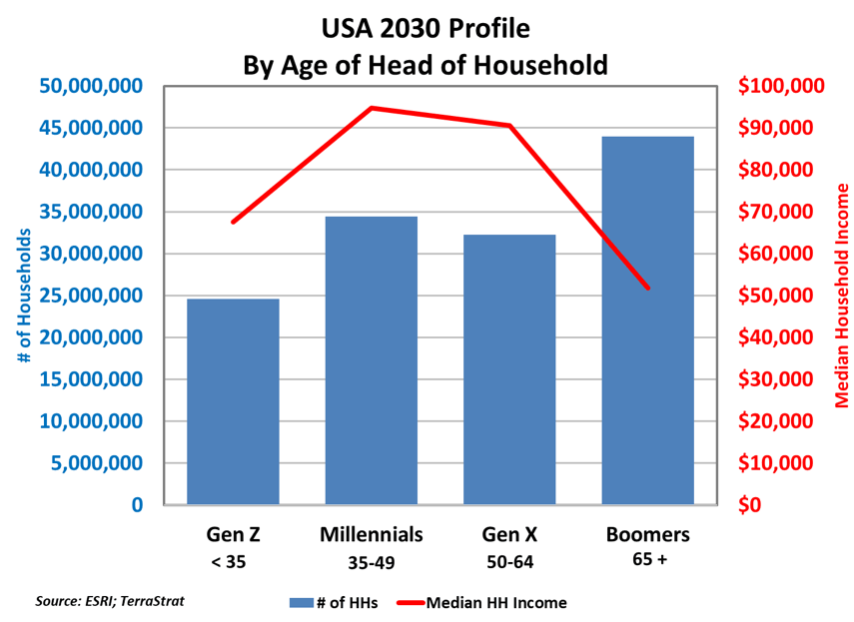

Combining these segmentation approaches requires manipulating the Census-based data to collapse categories into generational match groups. This ‘adaption’ of different approaches is a fairly routine procedure and yields some new perspectives, as seen in the chart below.

Households led by Baby Boomers form the largest segment at 35% of all households in 2020, followed by Gen X (26%) and Millennials (24%). There are far fewer Gen Z-led households, as many of those people still live with their Gen X and Boomer parents.

Gen X-led households have the highest median household income of the segments at $82,000, followed by Millennials at $71,000. Surprising, at least to me, is that Boomer-led households’ median household incomes are only $62,000. That figure must be pulled lower since half of the segment is over the typical retirement age of 65. Finally, Gen Z-led households have median household incomes comparable to the Silent Generation households—near $35,000.

As you might expect, age plays a big role in net worth. Median net worth for Gen Z-led households is low at around $10,000. With an average net worth of nearly $26,000, we can safely assume that many Gen Z households have net worth closer to zero. These young households have limited assets and are accumulating debt at an increasing pace.

Millennial-led households have about three times the median net worth of Gen Z households at $30,000, and Gen X households about three times the Millennials’ median at $94,000. Both segments likely have greater awareness of their net worth as they begin thinking about retirement down the road.

Boomer-led households’ median household net worth is about double that of Gen X at $194,000, with an average net worth over $1 million. The oldest generation has a median net worth of nearly $270,000 and an average just over $1 million as well. In or nearing retirement, these households are drawing down on their retirement savings to supplement any social security or pension benefits. These two oldest segments hold the bulk of the country’s consumer net worth.

Many financial firms have focused their marketing efforts on attracting the younger segments, especially Millennials and Gen Z. The so-called neo-banks are focused on these segments too, as their affinity for using digital channels is appealing. The opportunity to connect with a lower cost-to-serve population makes a good long-term business model. The challenge is that these two youngest segments control only 6% of total consumer net worth. In the short term, and by that, I mean the next 10-20 years, firms must continue to establish and maintain relationships with baby boomer households that comprise more than half of consumer net worth.

What Are The Segments Looking For From Firms?

When a recent BAI study of the generations asked respondents what they wanted from banks or credit unions, it found differences between the groups.

Gen Z, the youngest segment, is new to the world of consumer finances. They seek education, wanting to learn how the system works. The 2020 TIAA Institute-GFLEC Personal Finance Index measures financial literacy and found that this generation scored significantly lower than the older segments. Today, their needs are straightforward with a need for checking, savings (perhaps), and a credit card. Many are living paycheck to paycheck. They are the most technologically knowledgeable, having grown up not knowing a world without computers or cellphones.

Millennials know the ropes and want banking to be made simpler. They seek transactional convenience. Busy at work or raising children, their days are full and going to a branch takes time. Their financial needs are more complicated. Home purchases are on their minds, if they haven’t already taken that step, yet many are still carrying student debt. Retirement seems light-years away. Millennials came of age with the internet and are comfortable with informal communications through digital channels.

Gen X is beginning to worry. They want advice from a financial services provider. They are in their peak earning years yet wonder where all the money goes. They are behind in saving for retirement according to many articles in recent years. Carrying a mortgage on top of some lingering student debt and helping their children pay for college creates barriers to saving more. Gen X was shaped by a quickly changing world through events like the AIDS epidemic, the fall of the Berlin Wall, and the dot.com boom and bust. While Boomers are optimistic that hard work will lead to personal benefits, Gen X is more interested in work-life balance. If any firm isn’t meeting their needs, they are more willing to move on.

Boomers have done their time and built a retirement nest egg, but wonder “is it enough?” Many worry they won’t be able to retire when the time comes. They have lived through many recessions, big and small, and seen the impact on their savings and investments. Boomers seek security.

The Silent generation wasn’t included in the study. This generation was shaped by the instability of the Great Depression and World War II. Often referred to as the “traditionalist” generation, I can only imagine they want a better future for their children and grandchildren. Those that have survived to today have lived a full life. They hope they don’t outlive their savings, and I’m sure they don't want to be a burden on their grown children.

The majority of people use all channels over the course of a year, across all segments. In my experience, as new channels roll out, customers adopt the new channel over time and add each new channel into the mix of their interactions with their bank or credit union. Digital transformation has become the new buzzword replacing branch transformation in the industry lexicon. I often comment about how industry leadership chases the next bright shiny thing, and I hope this isn’t another occurrence.

JD Powers conducted a customer satisfaction study in 2019 that looked at consumers’ overall satisfaction with their financial services provider (1000-point scale). The main headlines were:

Branch-centric customers, who use branches more frequently, are more satisfied with their bank, across all generational segments.

Gen X was the least satisfied overall. Remember, this segment wants advice and is entering the most financially complex time of their lives.

Gen Z’s level of satisfaction is comparable to the oldest segment, the Silent generation. In other studies, they reported that Gen Z uses branches as frequently as the elderly. Remember, they want to be educated about the financial system. Could they be visiting branches so often because they don’t understand why they incurred certain fees or made a mistake?

But it wasn’t just that branch usage improved satisfaction. The pursuit of a digital-only customer has spawned many new firms in recent years. Even traditional firms have invested millions to beef up digital capabilities to attract these perceived “lower cost to serve” customers, yet satisfaction among digital-only customers is the lowest overall. These customers reported they felt like they did not have a “relationship” with the financial provider. The most satisfied group are those customers that have augmented their branch usage with digital channels when needed.

FDIC Channel Usage Study

Every two years the FDIC conducts a large-scale study of consumer banking behavior with the 2019 being the latest available data. The collected data can be disaggregated in several ways. Here is how it looks by generational households.

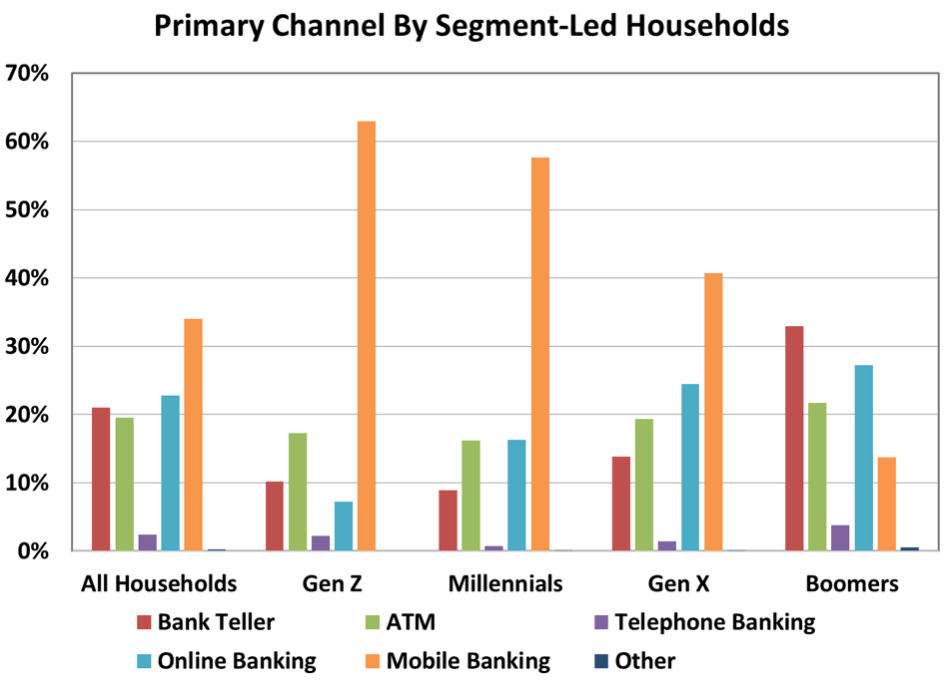

First, they look at which channel consumers consider their ‘primary’ channel for banking. [Note: This data is for the 95% of households who have a bank or credit union account.]

The mobile channel is considered the primary channel for all segments except for Baby Boomers. Mobile dominance declines with age. For the Baby Boomer segment, the branch is still seen as the primary channel for interactions. Most notable in this research is that all segments use all channels. The difference is just a matter of degrees. More than half of Boomer-led households view the physical channels (branch and ATM) as their primary channel.

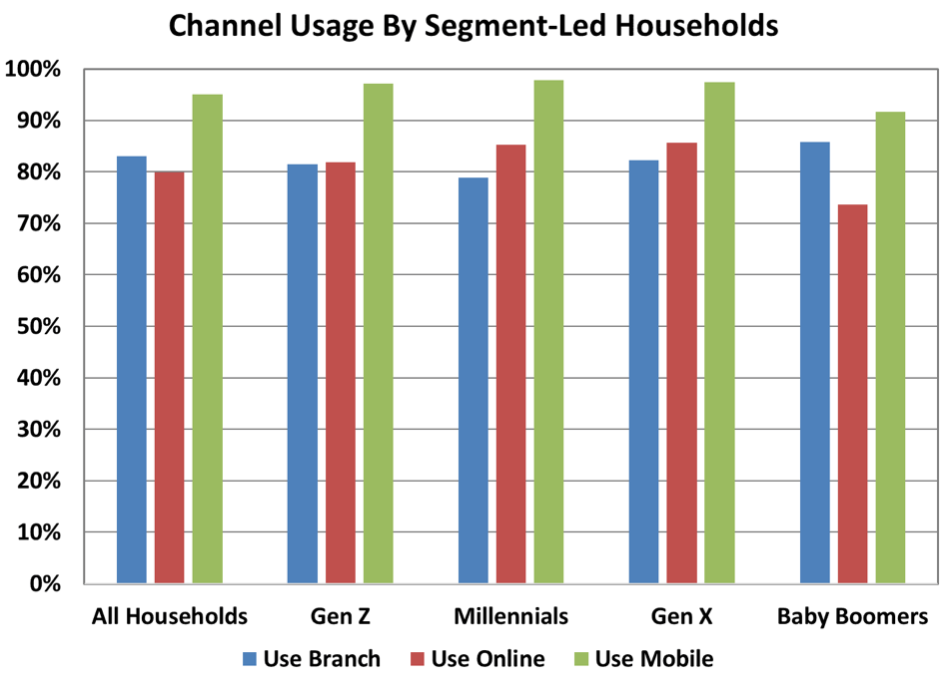

Just because a segment ‘primarily’ uses a specific channel doesn’t mean they don’t use the other channels. In my experience households collect channels and use the one that is most convenient for each individual transaction. The FDIC asks the survey respondents whether thy have use a particular channel in the last 12 months. Unfortunately, they did not report out this data for the ATM and call center channel.

The data they did report out for branch, online and mobile channels indicate that all segments use all channels over the course of a year. The three youngest generations have similar usage patterns, while Boomers, as expected are slightly less likely to use the digital channels. [A side note: The 2020 Covid19 pandemic drove significant shifts to digital channel usage as many branches were temporarily closed. It will be interesting to see the 2021 version of this study.]

Transformation Takes Time

In the consumer financial services business, few firms are ahead of the curve, predicting where the market is going. In fact, it’s critical to consider demographic changes over time, as transforming your bank or credit union doesn’t happen overnight. Here’s a simple example.

Let’s say your firm has a branch network of 20 branches built organically over the last 40 years, and the new CEO wants to rebrand the bank and ‘transform’ the branch network by automating more teller transactions through the rollout of TCRs at the teller line, retraining the staff to be universal bankers, and upgrading drive-up ATMs to ITMs. This branch transformation requires the current branch network to undergo extensive renovations on top of its extensive investments in the online and mobile channels. Given the required level of investment, the firm can transform two branches annually. A lot can change in the 10 years necessary for that plan to be implemented.

Let’s look ahead to 2030:

In 10 years, the Silent generation will largely be gone, unfortunately, with those who remain likely not living on their own, as they will be 85+ years old. Their remaining assets, though, will be passed down to their descendants giving these younger households a net worth boost.

Boomers will all be over 65 years old with the majority retired and out of the workforce. This group’s demand for loans will be low, and they will be net “de-savers” drawing down on their lifelong savings to supplement retirement pensions and social security. Average household net worth is likely well above $1 million.

Gen X will be in their peak earnings years with Millennials close behind. Loan demand will still be strong with mortgages, auto loans, and credit cards, but less so for the younger Millennials. Loan demand may be impacted by any lingering student debt. Savings rates will be at their peak as they prepare for retirement on the horizon. They will be focused on building wealth.

Millennials will have the highest incomes of the segments with most in the family-formation mode. Home purchases are on their mind if they haven’t already made that investment. Many will still be carrying student debt while also looking at college costs for their Gen Alpha children and struggling to save for retirement.

Gen Z will mostly be out of their parents’ homes and earning decent wages. Gen Z households will still have strong borrowing demand as they look to own homes, and many are likely to still be carrying student debt. Savings for retirement will have started but is likely an afterthought.

Generation Alpha is not quite forming households yet, at under 20 years old. More likely, they will be living with their Millennial parents.

Changing Demand

All of this shifting demand driven by life stage changes will likely result in greater overall loan demand but reduced overall savings rates. The fight to capture low-cost deposits will be intense.

Generation Alpha is now in the game as the newest segment forming their own households. Like Gen Z before them they will be comfortable transacting via digital channels but need financial education.

Back in 2020, Gen Z sought education about their financial options. Did they receive it? In 2030, they will be busy with life. Things will be getting more complex. In that same JD Powers study, the two younger segments were not only more likely to seek out advice, but they were also more likely to use the advice they received when compared to older segments. The concept of evolving today’s branches into tomorrow’s “advisory” centers makes sense.

At 25 years old or less today, they have had limited exposure to how the system works and likely use only the most basic of products (checking, savings, and credit cards). But 10 years later, they will be immersed in the need for more complex financial products and feeling the pressure to purchase their first home or upgrade to a larger home to deal for a growing family. The pressure to begin saving for retirement will be growing too. The need to be educated about the expanding breadth of financial services options isn’t going away. More likely, it is intensifying. They are the most technologically savvy of the segments and will handle routine transactions digitally.

Millennials were all about transactional convenience 10 years ago, but now their worlds are more complex. They have the highest incomes of the segments with most in the family-formation mode. Retirement now seems way too close. Even though they have high earnings, the anxiety about saving for retirement is intensifying. They wonder, “how do I save for retirement while still carrying student debt and saving for my children’s college years?” They need advice but aren’t used to going into the branch.

Gen X is in their peak earnings years. Loan demand will still be strong and as will savings building with retirement only a few years out. Ten years ago, they sought advice. Did they get it?

Boomers will all be over 65 years old with the majority retired and out of the workforce. They sought security in 2020. If another financial crisis happens in the next ten years, how will they react? Will savings shift to annuities or low-risk investments? This group’s demand for loans will continue to be low and they will continue to be net “de-savers” drawing down on their lifelong savings to supplement retirement pensions and social security.

Common Themes

Across all segments, there are some common themes in 2030. Every generation will have lived through roller-coaster economies, whether driven by more traditional cyclical economic changes or self-inflicted bubble-bursting events. They search for knowledge and predictability. They want to be informed and respected. They want firms to make it easy for them to connect, as they will have multiple methods for completing routine transactions.

Gaining knowledge about the financial services industry doesn’t mean going to seminars. Remember these folks are used to learning online, so creating an educational curriculum for your customers that is available when they need it will be critical. Online education broken down into bite-size chunks must be offered. If those offerings cause your customers to seek out staff members for more information, that creates moments for relationship-building.

The best firms will be defined by how well they have built relationships with their customers. Psychologists tell us that relationships are built on trust, respect, and communication, among other factors.

They want to trust that their financial services providers are giving them accurate advice. They want to understand how the financial system works and what options they have. They want to know the employees they interact with are knowledgeable.

They want to be respected for being a customer and member of the community. Respect means being treated fairly and personally, not just as another account number. When they need help, whether in person or on the phone, they don’t want to wait and they don’t want to have to explain themselves 2-3 times as they are transferred from person to person. Don’t just tell them that their relationship is important to you, show them through your behaviors.

They want clear communications, whether about routine events or when there are unexpected problems. Fee structures and how to avoid fees must be clear. Basically, they want “no surprise” banking.

As banks and credit unions sit down this year to create a new 5-year strategy or update an existing plan, they should consider all these demographic changes.

Digital channels will be preferred for routine transactions, but they will need to better connect with human channels for it’s the human channels where relationships are built.

ATMs, both at branch sites and remote sites, will continue to be critical touchpoints for customers to perform routine transactions, including getting cash and making deposits. The remote ATM site will become even more important since branch closures will likely continue, especially as the industry consolidates.

Human channels will be critical, but the branch channel of the future will certainly look different than today. Less a transactional site, and more a place to become informed and seek advice. The breadth of products people will want to discuss will be broader than today, and customers will want employees to be better informed than today. No one wants to seek advice only to realize that they know more than the advice-giver. Call center staff need to be accessible and not buried behind multiple layers of call tree selections. Like in branches, the person who answers the customer’s call needs to be knowledgeable.

Recap

The interest in “Generational” marketing to attract the younger Gen Z and Millennial households, who are digitally-savvy, has grown in prominence in recent years as neo-banks have entered the marketplace. These firms aspire to create a large base of digital-only customers long-term. The challenge is that these customers have minimal assets, with Gen Z and Millennial households controlling only 6% of total consumer net worth. While attracted to the transactional convenience, they are also the least satisfied with the digital providers. They want to be informed and educated, and as they get older and have more complex financial needs, they will want trusted advice.

It seems there is little discussion today about Baby Boomers and Gen X households, even though they control over ¾ of consumer net worth. Whether it’s because financial firms believe Boomers and Gen Xers will not change their banking relationship, or that they still want expensive branches is unknown. What is known is that these segments form the greatest opportunity for profitable relationships.

The industry’s overall approach to driving costs down in all channels must be rethought. Providing transactional convenience is easy, as shown by the proliferation of neo-banks today. They are disrupting the industry by carving off a small piece of what more traditional banks and credit unions offer. Building relationships with customers is harder and is done through human interactions, something neo-banks can’t do today and will find costly to provide in the future.

All segments, regardless of age, want information and advice. It can be delivered in a variety of formats to allow customers to access the information on their terms and timeline. But when customers have questions, they will want to talk to a knowledgeable associate whether on the phone or in-person at your transformed advice centers.

Mark Sievewright, Founder & CEO at Sievewright & Associates, sums it up well. Sievewright says, "Incredibly, at least six distinct generations live side-by-side in the United States today. Technology has given young people an unprecedented degree of connectivity among themselves and with the rest of the population. That makes generational shifts more important and speeds up technological trends as well. For financial institutions, this shift will bring both challenges and equally attractive opportunities. An aging workforce, ageing consumers, generational shifts in terms of economic power and the rise of Generation Z will have profound implications for the industry. Financial firms will need to anticipate demographic developments and bring products and services into line with the changing population base in the markets they serve. Additionally, younger age groups are made up from a more diverse population while older age groups tend to be less diverse. This dramatic generational difference in ethnicity will have deep implications in the years and decades to come.”