Blog

Still Waiting for the Retail Apocalypse?

How data, not intuition, is critical to winning in the post-pandemic retail marketplace.

The pandemic, in addition to upending our lives in general, generated enormous speculation around the state of brick-and-mortar retail in 2022 and beyond. The COVID shutdowns raised serious questions as to whether stores would survive at all, and if they did, whether retailers would invest in – or divest from – their physical networks.

Branch Strategies For The Next Five Years

The next five years in retail financial services will be quite different from the last five. The past five years have seen near-zero interest rates, slowing of retail expenditures, high unemployment, limited migration, huge stimulus infusions, and compressed margins. The next five will be different. Are you ready?

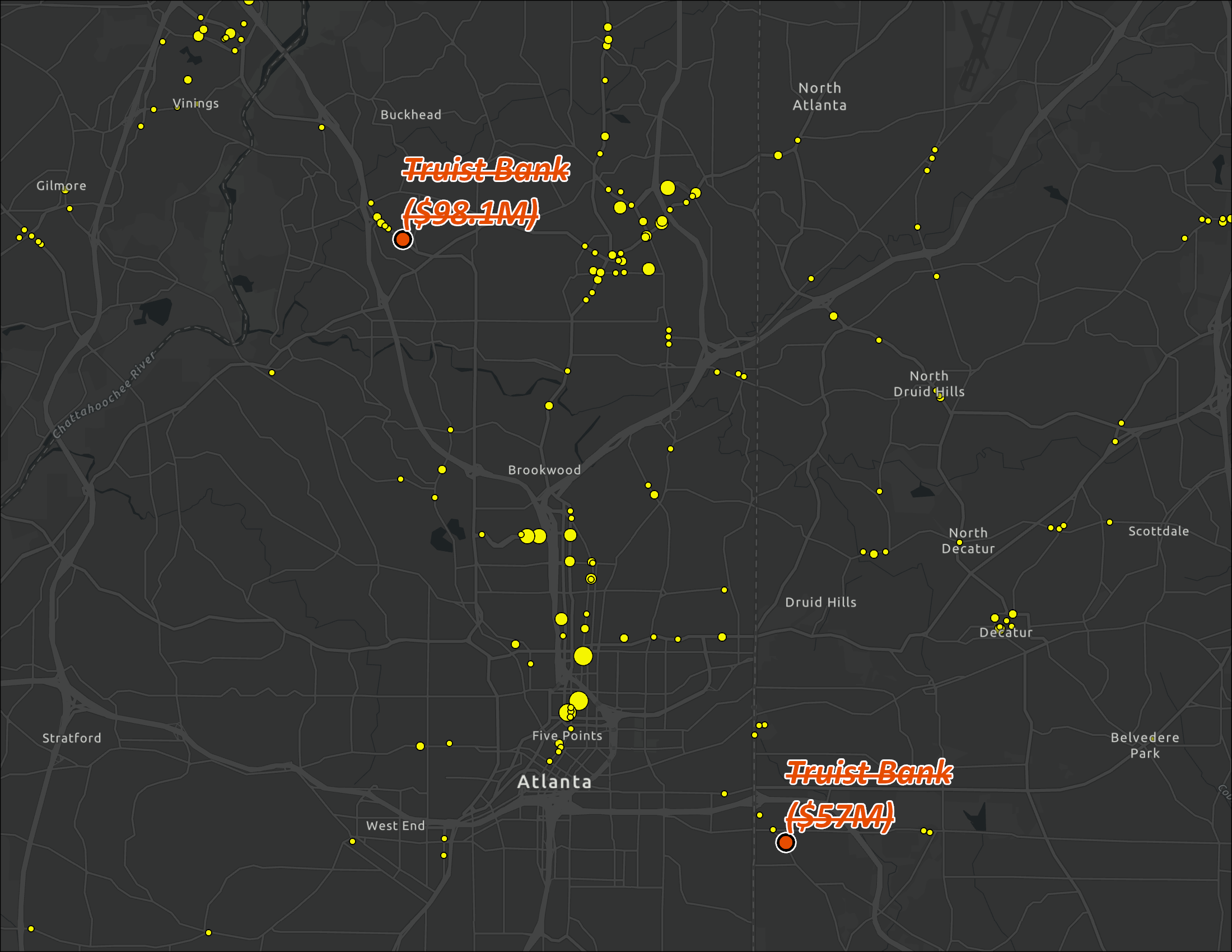

Do Branch Relocations Work?

A portion of new bank branch builds involve the simultaneous closing of a nearby branch. In these cases, the FDIC considers the situation a relocation. They represent about one of every six new branches being built today. Typically, the banks who invest in relocations have found that the area immediately around the old branch has changed and nearby newer developments may be more appealing to new and existing customers. Those banks are often hoping for faster deposit growth. Do they get it?

The Continual Decline in Bank Supermarket Branches

The concept of putting a bank branch inside a supermarket has been around for decades. Initially, it made sense. Distribution strategists know that aligning branches near supermarkets tends to yield better deposit growth, so why not put them inside the store? We’ve learned a lot in those decades … about why supermarket branches rarely make financial sense. The number of bank-branded supermarket branches has been declining for years, and last year was no different.

Understanding the FDIC Share of Deposit Data

Every year, bankers, credit union leaders, industry analysts, and consultants get excited about the release of the FDIC’s annual Share of Deposit database. In a world filled with data, in an industry awash with facts, this is the one database that provides local data on branch performance. A singular piece of data that drives many thousands of analyses. But do you understand what’s in the database and what its limitations are? Let me explain.

Generational Perspectives in Financial Services

The use of generational segmentation has taken hold in the financial services industry. Seemingly everyone is enamored with the pursuit of Gen Z and Millennials as attractive targets. Certainly, there are differences between the various generations as they all came of age during different periods. But are those differences more important than the common elements they all share?

If The Future of Retail Banking is About Relationships, Why Do Automated Phone Systems Exist?

In many retail banking articles and conference speeches today, you hear about retail banking shifting away from a transactional business, with phrases like “relationship banking,” the “importance of customer relationships,” and “the future is about building a trusted advisor relationship with our customers.”

Some Simple Guidance Around Branch Closures – 6 Things to Consider

Branch closures have been increasing in recent years. Like any business change, they come with some risks. Those risks can be mitigated by being smart about how you decide which branch to close and how you pre-stage the end-state network to take care of your customers.

Is There Such a Thing as an Optimal Branch Network?

Optimal shouldn’t be thought of as a unique solution. The optimal solution for any bank or credit union, must consider their existing customer base, the markets they serve, any target segments they want to attract, and the capital and budget constraints.

Is the US Trailing the World on Digital Payments?

The concept of cash has been around since before recorded history, and the practical use of permanent paper currency for 350 years. In recent years, more experts are predicting the death of cash as digital payments grow more commonplace.

Did COVID19 Finally Kill Cash Usage in the US?

For years, many in the financial services industry have been predicting that the US would go cashless in a very short while. Generally, these people work for digital payments companies, so they clearly have a biased viewpoint. Some recent articles have been touting that Covid19 brought the United States to the tipping point, or in other words, put the final nail in the coffin. But what do the facts say?

Are All Retail Centers the Same?

Aligning your next new branch to a grocer-anchored or big-box shopping center makes good sense. But are all centers equal? Now, we can measure every center’s ability to best reach your target customer.

Are Your Branch Analyses Misleading?

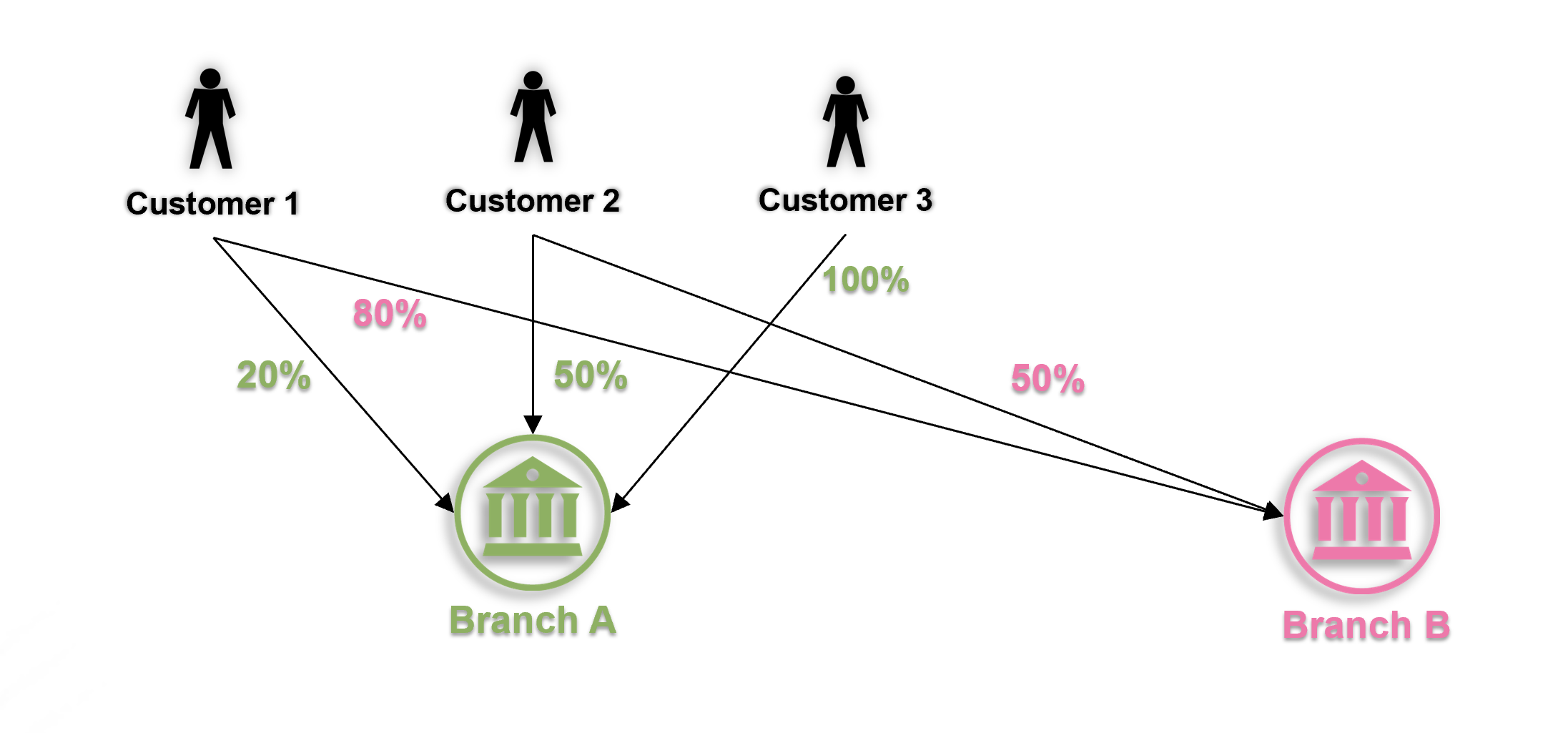

One of the standard metrics analyzed when evaluating branch performance is the size of the customer base (or in a credit union’s case member base). This measure is used as a gauge of the branch’s performance or health. The problem is that too many firms still rely on an old-fashioned account domiciling approach that assigns accounts (and households) to the branch where the account was originally opened… regardless of how many years ago that occurred.

Have You Ever Wondered How Modern-Day Distribution Analytics Developed?

A review of some of the underpinnings of retail distribution analytics and strategies for financial services providing layman’s explanations of some complex calculations and why they are important for branch planners today.

The Long-Term Impacts On Demand From COVID19

The impacts of the COVID19 pandemic on society are severe and documented daily. The pandemic brought on an economic recession, high unemployment, a spike in business failures, especially in the restaurant industry, disruption of the educational system, and massive increases in federal debt. The approaching “new normal” is likely quite different from the “old normal” pre-pandemic.

What Roles Do Remote ATMs Play In A Local Network?

Remote ATMs, or those machines not located at a branch site, historically have been limited to cash dispensing. Most were operated by third-party ISOs (or Independent Service Operators). Most still are today as banks have been slow to realize the potential of building out a branded, owned remote ATM network.

Should You Be Concerned That Your Branch Trade Areas Overlap?

One of the common situations we see with branch networks is that they are either too sparse within a market or too tightly clustered together. It’s important to have some scale to a branch network to improve your probability of achieving outsized results. But building more doesn’t mean building more just down the street from each other. Branch spacing is important as well.

How Many Branches Do You Need To Serve A Market?

One of the most frequently asked questions we get from executives at banks and credit unions is “How many branches do I need?”

It’s a simple question, but as you can guess, it needs a nuanced answer. The right answer is it depends on your overall strategy, expectations, and market conditions.

Looking For More Insights?

Have questions? Want to speak with a member of our team? Get in touch with us now to get started on your next project.